5 Types of Insurances Security Guard Companies Need

Tue, Dec 20, 2022

Read in 10 minutes

The reason is that, compared to most other professions, security guards have to deal with the danger to a greater extent. So insurance is not a negotiable aspect of your security guard business.

Types of Insurance Policies For Security Guard Businesses

The nature and size of your security guard business play a crucial role in determining the type of insurance you need. These insurance policies are generally customized to cater to the unique requirements of business organizations.

Suppose your business is a sole proprietorship; it will automatically need a different insurance policy than a company. Customizing your insurance policies means you do not pay a premium for what you do not need to insure.

Before you learn and get into counting dollars, it’s better to get a general idea of the types of security company insurance is there. You can have-

- General Liability Insurance

- Commercial Automobile Insurance Policies

- Workers’ Compensation Insurance

- Commercial Umbrella Insurance Policies

- Professional Liability Insurance Policy

- Business Owner’s Policy (BOP)

1) General Liability Insurance Policy

What is General Liability Insurance?

As the name suggests, General Liability Insurance (GLI) provides coverage to businesses against general claims. These claims include bodily injuries and property damage done on the part of the company. One can refer to a general liability insurance policy as one of the most basic policy coverage businesses need.

General liability insurance is a must-have for most professional service businesses. It covers claims related to bodily injury, property damage, and advertising injury. For small businesses, general liability insurance typically costs between $400 and $1,000 per year. However, this can vary depending on factors such as the nature of your business, the location, and the coverage limits you choose. Businesses that are exposed to higher risks, such as security companies, may pay more for this coverage.

In most cases, security guard businesses have to furnish proof of general liability to get the business license in the first place.

Why do you need General Liability Insurance?

Many even refer to general insurance as a variant of commercial insurance for protecting the security guard business from financial losses. However, the claims must arise from any property damage or bodily injuries. So, in the case where your security guard or patrolling officer gets in an accident while on duty and causes bodily injuries or property damage to a third party, this insurance will help you cover the losses.

2) Commercial Automobile Insurance Policies

What is Commercial Automobile Insurance?

Commercial Automobile Insurance is an insurance coverage most businesses avail of where there is a usage of automobiles or vehicles. For security companies, these vehicles mostly include patrolling cars. Security guards cannot do their jobs sitting idle in a place. They need to move across locations, and even if you are a small security guard business, you will need at least one vehicle. In such cases, get insurance for your patrolling vehicles to avoid losses when things go wrong.

If your business uses vehicles, commercial auto insurance is necessary to cover accidents, injuries, and damages involving company vehicles. The cost of commercial auto insurance can vary significantly based on the type of vehicles, how often they are used, and the driving history of your employees. On average, businesses can expect to pay between $1,200 and $2,500 per vehicle per year. Security companies that rely heavily on vehicles for patrols might see higher costs due to the increased risk of accidents.

Why do you need Commercial Automobile Insurance?

Commercial Automobile Insurance will cover the damages for you and other vehicles involved in a mishap. Additionally, these insurance policies offer cover for employees driving the car during the accident. Any property damage caused due to the vehicle accident also comes under this insurance policy.

3) Worker’s Compensation Insurance Policies

What is Worker’s Compensation Insurance?

Worker’s Compensation Insurance helps businesses provide coverage against any claims or lawsuits filed by their employees for losses or damages caused by the employer. In most regions, the worker’s compensation insurance is manadatory for security businesses. The law mandates organizations to take this insurance to ensure the welfare of their employees.

Why do you need Worker’s Compensation Insurance?

The employees or their family members may claim coverage in the case of loss of job, injuries during work, loss of wage due to injuries, death due to an accident at the workplace, or any other loss incurred due to the negligence of the employer. These insurance policies ensure compensation for employees.

If your business has employees, workers’ compensation insurance is usually required by law. This insurance covers medical expenses and lost wages for employees who get injured or fall ill due to their jobs. The cost of workers’ compensation insurance varies widely depending on your industry and the number of employees you have. For professional service businesses, the cost typically ranges from $0.75 to $2.74 per $100 of payroll. However, industries with higher risks, such as security services, may pay more.

4) Commercial Umbrella Insurance Policies

What is Commercial Umbrella Insurance?

Most security guard businesses are known for offering services that pose a danger to their employees. Such services are crucial for these businesses as it helps them make a mark for themselves in the market. Nonetheless, in such cases, it is highly recommended you take a commercial umbrella insurance policy. The policy provides insurance coverage for a variety of claims and helps businesses pay suitable compensation.

Why do you need Commercial Umbrella Insurance?

These policies cover much more than any other business insurance policy would. For instance, suppose your security guard business faces a lawsuit seeking considerable compensation. In such cases, an umbrella insurance policy will help you cover excess losses to minimize the impact on your business.

5) Professional Liability Insurance Policy

What is Professional Liability Insurance?

Professional Liability Insurance Policy covers damages caused by a lack of professionalism from your end. For instance, suppose a client is aggrieved and suffered losses due to some mistake from your end. In such cases, a professional liability insurance policy will help you cover your losses.

Why do You Need Professional Liability Insurance?

These are very useful for security guard businesses. But unfortunately, there can often be cases of false apprehension causing further complications. So a professional liability insurance policy can help you get out of the messy soup with minimal consequences.

Also known as errors and omissions (E&O) insurance, professional liability insurance protects your business if a client claims that your services caused them financial harm due to negligence, mistakes, or incomplete work. The cost of professional liability insurance can range from $600 to $1,800 per year, depending on the type of services you provide, the size of your business, and your claims history. High-risk industries, like security services, may see costs on the higher end of this range.

6) Business Owner’s Policy (BOP)

A Business Owner’s Policy (BOP) combines general liability, property insurance, and often business interruption insurance into one package, making it a cost-effective option for many professional service businesses. The cost of a BOP typically ranges from $500 to $3,500 per year, depending on the size of your business, the coverage limits, and the specific risks you face. For security companies, which may need more extensive coverage, the cost might be on the higher end.

Why Do Security Companies Need Insurance?

Security companies play a critical role in keeping people, property, and businesses safe. However, with this responsibility comes a significant amount of risk. From potential legal issues to unexpected accidents, security companies face various challenges that could lead to financial losses. This is where insurance comes into play. Having the right insurance coverage is essential for security companies to protect themselves, their employees, and their clients. Here’s why security companies need insurance and a look at the types of insurance they should consider. Security company insurance is more of an investment that will make you run your company easily.

1. Protection Against Liability

Security companies are often on the front lines, dealing with high-stress situations that can sometimes lead to accidents or injuries. If a security guard accidentally injures someone or causes damage to property while on duty, the company could be held liable. Liability insurance is crucial because it helps cover legal fees, medical expenses, and any settlements that may arise from such incidents. Without liability insurance, a single lawsuit could financially cripple a security company.

2. Coverage for Employee Injuries

Security guards work in environments where they may face physical risks, such as confrontations with intruders or hazardous conditions. If an employee gets injured while on the job, workers’ compensation insurance is essential. This type of insurance covers medical expenses and lost wages for employees who are injured while performing their duties. It also protects the company from potential lawsuits related to workplace injuries.

3. Protecting Company Vehicles

Many security companies use vehicles for patrolling and other duties. If a company-owned vehicle is involved in an accident, commercial auto insurance is necessary. This insurance covers the cost of repairs, medical bills, and any legal expenses that may arise from the accident. It also ensures that the company’s operations can continue smoothly without bearing the full financial burden of an accident.

4. Safeguarding Against Property Damage

Security companies often work on clients’ properties, which means there’s always a risk of accidental damage. Property damage insurance helps cover the cost of repairs if a security guard accidentally damages a client’s property while on duty. This type of insurance not only protects the security company but also reassures clients that they won’t be left out of pocket if something goes wrong.

5. Ensuring Business Continuity

In the event of a significant loss, such as a natural disaster, fire, or theft, business interruption insurance can be a lifesaver. This insurance helps cover lost income and operating expenses if a security company is forced to shut down temporarily due to an unexpected event. By ensuring that the company can recover and continue its operations, business interruption insurance helps maintain the company’s stability and reputation.

Factors That Influence Insurance Costs

Several factors can influence how much you’ll pay for insurance as a professional service business:

- Industry Risk: Businesses in higher-risk industries, like security services, generally pay more for insurance because they face greater potential for claims. Security business insurance usually comes in many forms and you will have to do proper research before making a decision.

- Business Size: Larger businesses with more employees, clients, or assets will typically pay more for insurance.

- Location: Where your business operates can also affect insurance costs. Areas with higher crime rates or stricter regulations may see higher premiums.

- Claims History: If your business has a history of frequent claims, insurers may charge higher premiums to offset the risk.

- Coverage Limits: The higher the coverage limits you choose, the more you’ll pay. However, higher limits also offer greater protection.

How do I get security guard insurance?

Getting the right insurance for your security guard company is essential to protect your business from risks like lawsuits, accidents, and property damage. Here’s a quick guide on how to get started:

1. Assess Your Needs

Identify the specific risks your business faces, such as liability, employee injuries, or vehicle use.

2. Research Providers

Look for insurance companies that specialize in security guard businesses. Check their experience and reputation.

3. Request Quotes

Get quotes from multiple insurers. Provide detailed information about your business to ensure accurate coverage options.

4. Compare Coverage

Review the coverage options carefully, paying attention to what’s included, the limits, and any exclusions.

5. Consult a Broker

If you’re unsure, consider consulting an insurance broker who can help you find the best coverage for your needs.

6. Purchase and Review

Once you’ve chosen the best option, purchase the policy. Regularly review and update your coverage as your business grows.

By following these steps, you can secure the right insurance to protect your security guard business and operate with peace of mind.

Conclusion

When it comes to security company insurance there are many options. You need to do proper research on which options suit your security services best. Get insurance that protects you from all angles should anything happen.

Security guard businesses already have a lot on their plate, so adding more hassle is not something anyone would want. Therefore, it is always better to be on the safer side and get oneself the necessary insurance policy based on their requirements. So get any of these insurance policies mentioned above to safeguard your security guard business.

Get a Free Trial

Sign up For Newsletter

Latest Blog Posts

Get Started

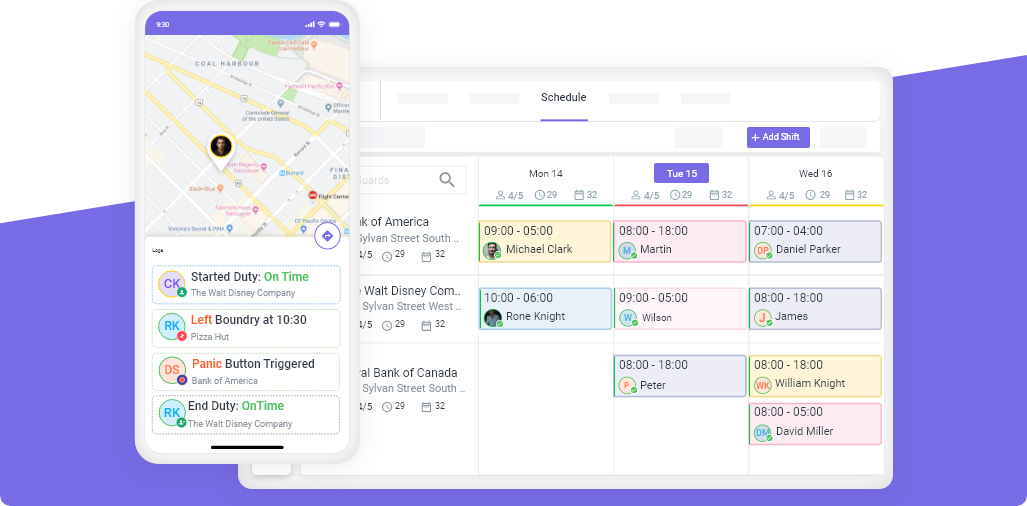

Start being productive & grow your business

with Novagems