How To Write An Invoice That Will Get Quick Payments

Mon, Mar 18, 2024

Read in 13 minutes

If you are one of those who searched “how to write an invoice” on Google because they want to look professional and get the clients excited to pay faster. Then you have come to the right place and your search ends here. In the cleaning industry writing a clear and professional invoice is important so that you can get quick payments. Now what is an invoice some might ask. Let me start from the basics.

An invoice is a bill that the company will send to their clients after a job is done. It includes a detailed overview of the type of services provided and total amount that is to be paid. Now you might think that to make invoice is simple enough. But sometimes there are specific requirements or information that needs to be added as well. And the ground reality is many businesses get the invoice template wrong and have been using the same since so long.

Now these errors can be simple but they can cause delays in the payments. To make sure that you are not the next victim, you can follow some simple steps like adding some simple invoice elements.

Invoice Essentials: Key Elements for Quick Payments

Essential invoice elements include multiple things. From simple to professional layout you get many things that can make your invoice template favorite amongst the clients. Writing an invoice may seem like a simple task, but crafting it correctly can significantly speed up payments and improve your cash flow. Making a quick invoice should not be the goal, making an invoice that will prompt quick payment is the end goal.

Getting a client is a tough job in the cleaning service industry. And retaining them is even tougher. You can get great new contracts if you give exceptional services. But all of that can go down the drain with one simple mistake. And that can also be a few late payments. This will cause frustration and in return cause your services to decline.

Professional Design

A clean and visually appealing invoice creates a positive first impression. Consider using your brand colors and logo for a cohesive look. There are multiple free invoice templates available to choose from that go the best with your business model and ideology.

Simple and easy-to-read layout

Don’t overwhelm your client with a cluttered invoice. Use clear fonts, proper spacing, and bullet points for easy readability. Things like white spacing, readable fonts make a huge impact on the clients.

Tone Of The Invoice

Setting a tone in your invoice is essential if you are looking for an invoice payment that is prompt and quick. Maintain a professional and polite tone throughout the invoice. However, don’t be afraid to clearly state the due date in a respectful manner. Invoice payment needs to be quick but you need to maintain a professional front at the same time.

Be Polite

Being polite in your invoice language can go a long way. Start your invoice with a friendly greeting and a “thank you for your business” message. Politeness can foster good relationships with your clients and encourage quicker payments.

Send Promptly

Timing is key when it comes to getting paid quickly. Always send your invoice promptly once the service or product has been delivered. The sooner the client receives it, the sooner they can process the payment.

Get to Know Your Clients

Understanding your clients’ payment cycles and preferences helps you manage expectations. Some clients might prefer invoices on certain dates, while others may need longer payment terms. Tailoring your invoicing to their needs can lead to faster payments.

Offer Incentives and Fines

To encourage prompt payment, consider offering incentives such as small discounts for early payment. You can also implement late payment fines to deter delayed payments. This creates urgency and increases the likelihood of receiving payments on time.

Follow Up

If payments aren’t made by the due date, don’t hesitate to follow up with a polite reminder. Sometimes, clients just need a nudge to take action. Sending friendly reminders can significantly increase your chances of getting paid quickly.

Purpose of an Invoice

An invoice is not just a document asking for payment; it serves multiple purposes:

- Record Keeping: It provides a record of the transaction for both the buyer and seller.

- Legal Protection: Invoices serve as legal documents that can be used in disputes over payment.

- Cash Flow Management: Invoices help businesses manage their cash flow by tracking expected payments.

An effective invoice clearly communicates the details of the transaction and sets the groundwork for timely payment. Which is crucial for maintaining healthy cash flow. A quick invoice payment will help you sort out the rest of the process that comes after. Like managing the inventory, paying your employees, and clearing out any dues.

How To Write An Invoice: Invoice Elements For Quick Payments

Now coming onto the real and juicy part that we all have been waiting for! A step by step guide that you can refer to while writing an invoice, for quicker and safer payment. Writing invoices that get quick payments is crucial for any business. Here are some additional tips to help you structure your invoice effectively:

-

Company Name And Contact Information

Your company’s identity is the cornerstone of your brand. Make sure your company name and contact information are prominently displayed at the top of the invoice. This not only facilitates communication but also instills confidence in your clients. Showing them that you’re accessible and reliable. This builds trust and your name in the industry.

Your contact information makes it easy for the clients to reach out and ask any questions if they have any. Your business name, address, phone number and email should be easy to read. The clients then contact you before and after making the payment and even refer you to friends and family.

-

Invoice Number

Assigning a unique invoice number to each transaction is more than just a formality; it’s a strategic move to streamline your invoicing process and maintain accurate records. Plus, having a systematic numbering system adds a touch of professionalism and organization to your business operations.

One of the key Invoice elements that must be included is invoice number. It needs to be on the top and easily visible. If you have a regular client and you have some unpaid invoices before you make invoice you need to get the previous ones cleared. You will need to tell the clients which invoice you are talking about to make the invoice payment.

-

Name And Address Of The Client

Personalization goes a long way in business. Address your client by their name and include their address on the invoice. It shows that you value their individuality and reinforces the human connection behind the transaction.

Your client does not become a faceless paying machine for your company but a member. This encourages them to pay on time. Make sure to include their name and address before sending the invoice template.

-

Invoice Issue Date And Payment Due Date

Time is of the essence when it comes to invoicing. Clearly state the date of issuance and the deadline for payment. By setting clear expectations upfront. You reduce the likelihood of misunderstandings and ensure a smoother payment process.

The due date makes it clear when the clients need to pay. And if you’d like you can mention the consequences (late fees, penalty) in the invoice itself. Every industry has many types of clients, the good, the bad and the ugly. But how you manage and deal with them sets you apart. Make sure you keep your clients happy and satisfied but remember you have a business to run as well.

-

Services Provided And Description

Transparency is key to building trust with your clients. Provide a detailed breakdown of the services or products rendered, accompanied by clear descriptions and terms. This not only helps your clients understand what they’re paying for but also minimizes the risk of disputes down the line.

If you provide a one liner of description that makes it easy for the clients to recall the services they had asked for. The clients will most likely make invoice payment if they know what they are paying for. This minimizes unnecessary calls for clarification and follow ups.

-

Amounts Charged For Each Line Item

Break down the total amount due into individual line items, making it easier for your clients to understand the breakdown of costs. Be transparent about the quantity, unit price, and total amount for each item, leaving no room for ambiguity.

Knowing What to put on an invoice with a little description that explains itself makes a huge impact. It makes payments easy and quick without any confusion or clarification needed. This will naturally delay the payments and cause irritation for everyone involved.

-

Total Amount Due

At the end of the day, it all boils down to the bottom line. Summarize the total amount due prominently on the invoice, ensuring that it’s the focal point of attention. Whether it’s a straightforward figure or a detailed calculation, clarity is paramount.

It should be mentioned at the bottom line of the amount charged for each item or service. A good invoice template might even make it bold to make it easy to read. Total amount includes all of the taxes or additional costs that might be added. Make sure that the amount is calculated correctly.

-

Invoice Payment Terms And Payment Methods

Communication is key in any relationship, including the one between you and your clients. Clearly outline your payment terms and accepted payment methods, leaving no room for confusion. Whether it’s bank transfer, credit card, or online payment platforms, make sure your clients know how they can settle their invoices.

Mention any specific instructions that might be needed. This step is important to maintain good relations with your clients and avoid any disputes. You can discuss payment terms and methods while sending the quote so that the clients are informed beforehand without any confusion.

-

Taxes Included (If Any)

Taxation may not be the most glamorous topic, but it’s a necessary one. If taxes apply to your transactions, be transparent about the tax rates and amounts included in the total. Being upfront about taxes demonstrates your commitment to compliance and integrity in your business dealings.

These taxes might vary from state to state so any company that is just starting needs to be sure they are mentioning the correct taxes. This can even land you in legal trouble if incorrect data is mentioned. Hence it makes it one of the crucial Invoice elements that needs to be included in your invoice template. So if you ever make an invoice or search for another example of “What to put on an invoice” online, make sure this point is mentioned.

-

A Thank You Note

Gratitude goes a long way in fostering goodwill and building lasting relationships. Close your invoice with a heartfelt thank you note, expressing your appreciation for your client’s business. It’s a small gesture that can leave a big impression and set the stage for future collaborations.

Even if the invoice you are sending is a serious and legal document, you can always make it personal and professional. How? By adding a simple “thank you for choosing us!” note at the end. Make your company’s invoice template in such a way that it is pleasing to read. If you’d like you can include additional information such as valuable feedback needed or any upcoming deals they can look out for.

Some Invoice Payment Terms You Need to Know

Understanding the right payment terms is crucial when creating an invoice. Payment terms outline when and how you expect to be paid, setting clear expectations for your clients. Common payment terms include:

- Net 30: Payment is due within 30 days of the invoice date.

- Due Upon Receipt: Payment is expected immediately after receiving the invoice.

- 2/10 Net 30: Offers a 2% discount if paid within 10 days; otherwise, the full amount is due within 30 days.

- Payment Method: To make payment as simple as possible you need to include all possible payment terms in the invoice. Cash, debit or credit card, portals, or other methods can be included on the invoice. This will encourage the clients to make a quick invoice payment. Also, make sure that your banking details are correct.

Using clear and standard payment terms helps avoid confusion and ensures that both you and your client are on the same page regarding when payments should be made. The key to learning how to write a simple invoice is literally to keep it simple.

The Importance of Invoice Date for Cash Flow

The invoice date plays a pivotal role in managing your cash flow. It marks the start of the payment period and determines when the payment is due. For example, if you issue an invoice with “Net 30” terms on September 1st, the payment is due by September 30th.

Setting and clearly displaying the invoice date helps both parties track when payments are due, reducing the likelihood of delays. Additionally, consistently issuing invoices promptly after delivering a service or product can significantly improve your business’s cash flow.

Some Crucial Important Terms to Know

To write an effective invoice, you should be familiar with a few key terms:

- Invoice Number: A unique identifier for each invoice, which helps in tracking and referencing.

- Purchase Order (PO) Number: Often used in B2B transactions, this number links the invoice to the original purchase order.

- Line Items: The individual goods or services listed on the invoice, including descriptions, quantities, and prices.

- Subtotal: The total cost before taxes or discounts.

- Total Due: The final amount the client needs to pay, including taxes, fees, and any applicable discounts. Make sure that payment instructions on the invoice examples are followed correctly.

- Payment Due Date: The exact date by which payment is expected.

- Accepted Payment Methods: Clearly state the methods through which payment can be made (e.g., bank transfer, credit card, PayPal).

- Late Payment Penalties: If applicable, include information about late fees or interest charges for overdue payments.

These terms set clear expectations and encourage clients to pay on time, helping you maintain a steady cash flow. Understanding and correctly using these terms ensures that your invoice is clear and professional, making it easier for clients to process and pay it quickly.

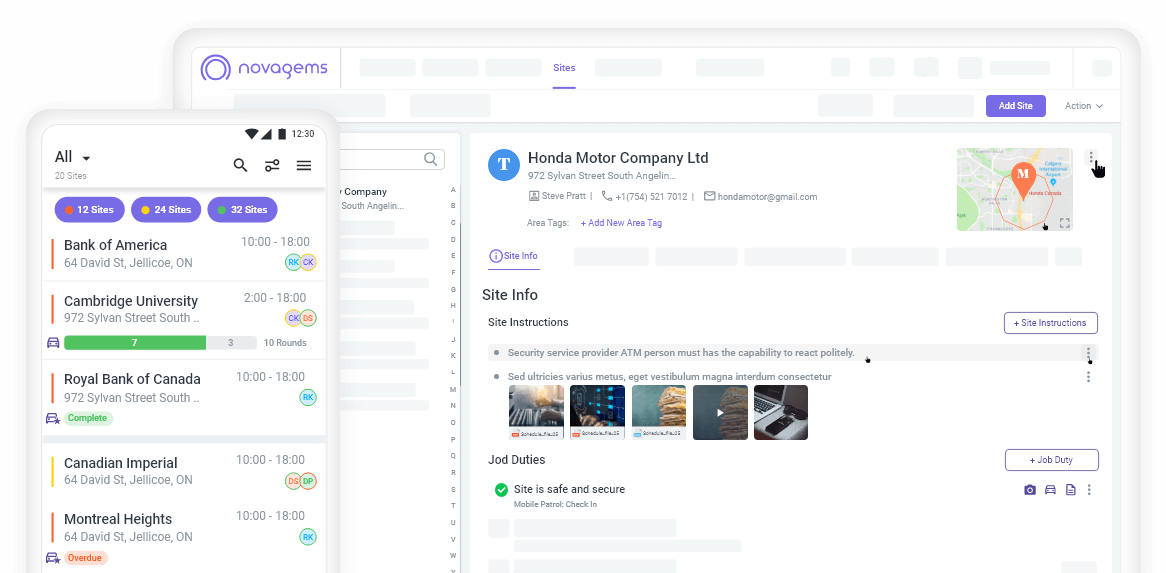

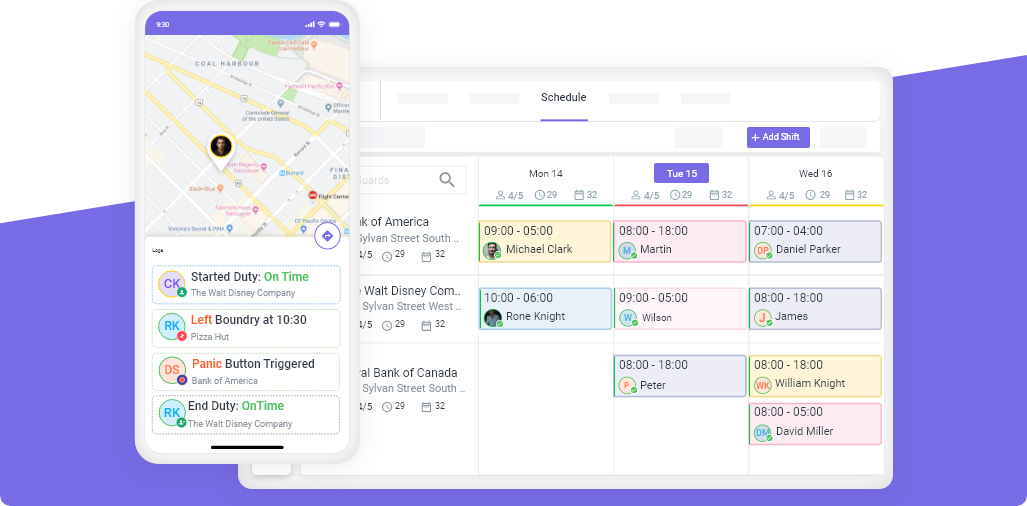

Benefits of Using Invoice Software

Using invoicing software can streamline the process and offer several benefits:

- Automation: Automatically send invoices and reminders, reducing the risk of human error.

- Tracking: Easily track which invoices have been paid and which are outstanding.

- Customization: Create professional, branded invoices tailored to your business.

Conclusion

Remember, behind every invoice is a human connection, and by infusing your invoicing process with empathy, transparency, and gratitude, you can elevate your business to new heights of success. Now the search for “how to write an invoice” comes to an end you can hop onto the next step and make one of your own invoice templates.

Writing an invoice that gets quick payments involves more than just listing services and the total amount due. By understanding and using key payment terms, setting clear due dates, and possibly leveraging invoicing software, you can significantly improve your chances of getting paid promptly. This not only boosts your cash flow but also helps maintain good client relationships.

By following these guidelines, you can learn how to write an invoice for payment. And in the same time make sure that they are clear, professional, and effective in securing quick payments.

Get a Free Trial

Sign up For Newsletter

Latest Blog Posts

Get Started

Start being productive & grow your business

with Novagems