Cleaning Business Insurance: Everything You Need To Know

Mon, Jun 12, 2023

Read in 7 minutes

When it comes to getting insurance for your business, know that it is not a choice but more of a necessity. If a business runs without adequate insurance overages, it is subject to market risks, lawsuits, and other losses along the way. The same is true for cleaning companies. If you’re running such a business, you must have cleaning insurance for your company.

Running a cleaning business comes with its own set of risks and challenges. From potential property damage to accidents involving employees or clients, having the right insurance coverage is essential for protecting your business. In this comprehensive guide, we will delve into the world of cleaning business insurance, providing you with the knowledge you need to make informed decisions and safeguard your cleaning company.

Understanding Commercial Cleaning Insurance

Cleaning business insurance, just like any other insurance, protects a cleaning company against accidents and lawsuits.

In a majority of cases, it is mandatory for cleaning companies to have cleaning insurance for their property, staff, equipment, and vehicles.

Such insurance is not a unique type of coverage but a set of different insurance coverages that a cleaning company can avail of. With cleaning business insurance, companies can get protection against any potential threats that can pose a threat to their resources and income.

Risk Management And Insurance Benefits For Cleaning Services

Here are a couple of points on the benefits of cleaning business insurance:

- Coverage Against Losses:

The idea of any company behind getting business insurance is to avail of the protection it provides against several business risks. In the case of a cleaning business, there are high chances of accidents like slip-and-fall. If your employee, client, or any third party suffers because of negligence on your part, the matter may end up in a lawsuit. Having comprehensive coverage will help the cleaning company to protect themselves from unnecessary claims.

Cleaning insurance will protect you against the losses that a lawsuit may incur by protecting coverage for the expenses. So, you don’t have to pay all compensations entirely from your pocket because your insurance company has got your back.

- Induces Reliability:

Another reason why you need cleaning insurance is that it makes your company seem trustworthy. If a client is in talks with your company about starting a new cleaning project, they are bound to ask questions about your insurance. A cleaning company that is covered by adequate cleaning business insurance is generally in the good books of clients.

So, having a cleaning business insurance helps with the reputation of your company in front of your leads.

Comprehensive Insurance Policies for Cleaning Businesses

- Liability Insurance

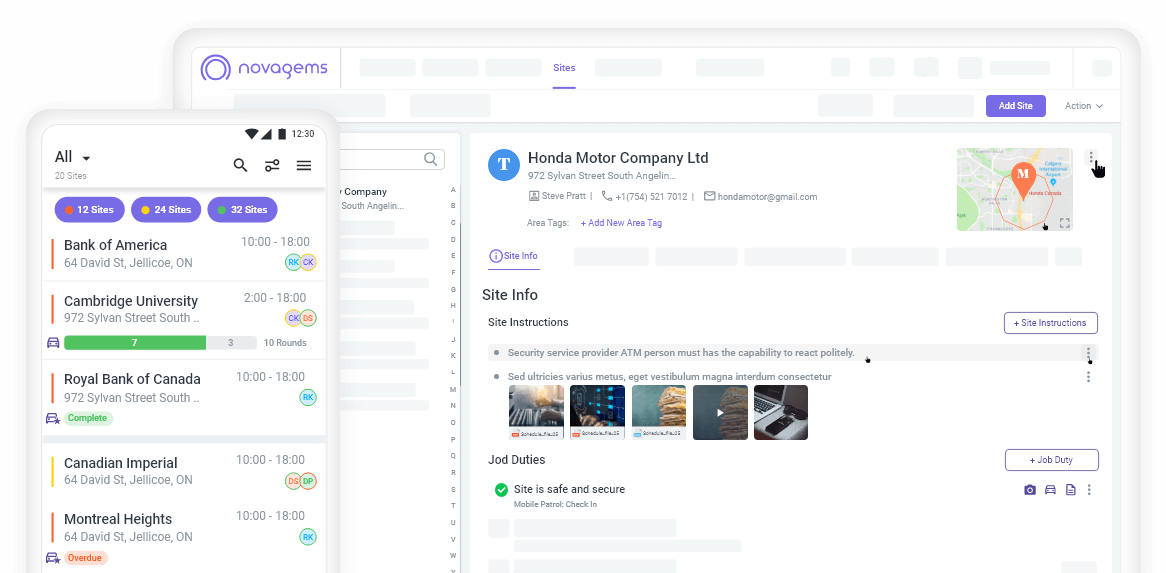

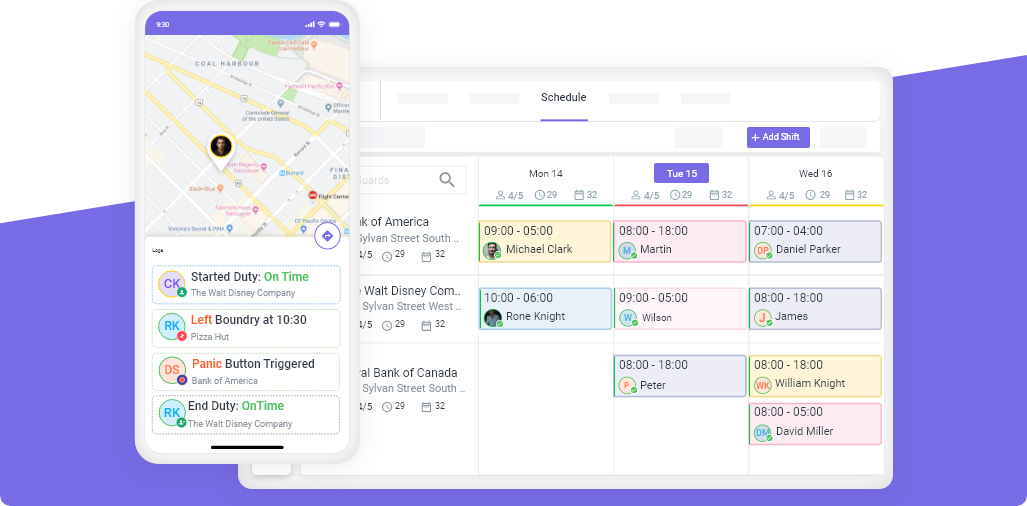

Professional cleaners work on the property of their clients. There is no denying that errors or mistakes are bound to happen in such a business. Such errors are evitable, even if you streamline all your work through cleaning software for business. They can also be big or small. However, if they end up in property damage or injury to others, the cleaning company shall be prepared for a lawsuit.

If you have insurance coverage, these lawsuits are paid for by the insurance companies. There are two types of liability insurance for businesses - General Liability and Professional Liability (or Errors and Omissions).

In the former, an insurance company will provide coverage if there are damages caused to property or injuries caused to people other than the cleaning staff. In the latter, an insurance company will provide coverage for financial losses incurred by the business because of the cleaning employees. Both these types of cleaning insurance are crucial for your business.

General liability insurance is the foundation of any cleaning business insurance policy. It provides protection against third-party claims for bodily injury, property damage, and advertising or personal injury. For example, if a client slips and falls on a wet floor while your cleaning crew is working, general liability coverage would cover the medical expenses and potential legal costs associated with the incident.

- Worker’s Compensation Insurance

As the name suggests, a Worker’s Compensation Insurance is to provide coverage against employee matters. For example, if an employee gets injured at work or dies due to an accident while cleaning, the company is liable to compensate them.

If your cleaning company has Workers Compensation Insurance, the expenses will be covered by the insurance company. This insurance also pays for the wages lost by the cleaners due to their injuries.

- Tools and Equipment Cleaning Insurance

Even if you use cleaning software for business, you still need your tools.

Of course, a business like a cleaning company is bound to have its tools and equipment. Now, what if they get lost, stolen, or broken? Your company will incur all the expenses of replacing them.

However, you don’t have to do that if you have Tools and Equipment Insurance. You can add this one to your general liability insurance. It will help you cover the expenses of replacing your gear or repairing it.

- Commercial Auto Insurance

Cleaning companies carry their equipment in their business vehicles like a van, trucks, or cars. These vehicles hit the roads and are prone to theft, vandalism, and accidents. So, getting commercial auto insurance is also crucial for cleaning companies for their vehicles. This type of cleaning insurance is also required legally in a majority of states.

So, these were all the types of insurance covered under cleaning insurance. You can contact a business insurance company and look at your options. It is also possible to customize insurance policies as per the requirements of your business. Therefore, ask your insurance agents what can be done to get the best, most affordable cleaning business insurance plan for your company.

Importance of Liability Coverage for Cleaning Companies

Liability coverage is of utmost importance for cleaning companies due to the nature of their work and the potential risks involved. Here are some key reasons why liability coverage is crucial for cleaning businesses:

Protection against Accidents and Injuries:

Cleaning involves tasks that can lead to accidents and injuries. Slips, falls, or mishaps with cleaning equipment can occur, resulting in bodily harm to clients, employees, or third parties. Liability coverage provides financial protection by covering medical expenses, legal fees, and potential settlements or judgments in the event of such incidents.

Coverage for Property Damage:

Despite exercising care, accidents can happen, and property damage can occur during the cleaning process. For instance, a cleaning solution could damage expensive flooring, or a valuable item could be broken. Liability coverage helps cover the costs of repairing or replacing damaged property, minimizing financial strain on the cleaning company.

Client Satisfaction and Trust:

Liability coverage demonstrates a cleaning company’s commitment to professionalism, accountability, and quality service. Clients are more likely to trust and hire a cleaning company that carries liability insurance, knowing that they will be protected in case of any unfortunate incidents. It enhances the reputation of the business and provides peace of mind to clients.

Legal Compliance:

Depending on the jurisdiction, cleaning businesses may be legally required to carry certain types and levels of liability insurance. Failing to comply with these requirements can lead to fines, penalties, or even the suspension of business operations. Having appropriate liability coverage ensures compliance with legal obligations and protects the business from potential legal consequences.

Protection against Lawsuits:

In the litigious society we live in, lawsuits can arise from a range of circumstances. A dissatisfied client, an injured employee, or a third party affected by the cleaning activities could file a lawsuit seeking compensation. Liability coverage helps cover legal defense costs, court fees, settlements, or judgments, mitigating the financial impact on the cleaning company.

Peace of Mind for the Business Owner:

Running a cleaning business comes with inherent risks. Having liability coverage in place provides peace of mind for the business owner, allowing them to focus on daily operations and growth without constantly worrying about the potential financial consequences of unforeseen events.

It’s important for cleaning companies to carefully assess their specific risks and consult with insurance professionals to determine the appropriate types and levels of liability coverage needed. By securing comprehensive liability insurance, cleaning businesses can protect themselves, their employees, and their clients from the potential financial burdens associated with accidents, injuries, or property damage.

Conclusion

Insurance for cleaning companies is a vital investment for protecting your business, employees, and clients. By having the right insurance coverage in place, you can mitigate financial risks, ensure continuity of operations, and demonstrate your commitment to professionalism and responsibility. Don’t overlook the importance of insurance—it’s a solid foundation for the long-term success of your cleaning business.

Get a Free Trial

Sign up For Newsletter

Latest Blog Posts

Get Started

Start being productive & grow your business

with Novagems